So, you want to travel the world, but your bank account is giving you major side-eye? Been there, my friend. But before you give up on that dream trip to Bali or backpacking through Europe, let me introduce you to a little thing called “budgeting” (don’t yawn yet, I promise this is gonna be fun).

Saving for travel doesn’t have to mean giving up your daily lattes or avoiding brunch like it’s a financial plague. Whether you’ve got $100 or $10,000 to put towards your next adventure, there’s a travel savings plan for every budget. Ready to start stacking that cash? Let’s dive in.

1. The Weekend Warrior: Saving for Short Getaways

So, you’re not looking for a year-long sabbatical in Southeast Asia, but you are dying for a weekend escape to recharge. Enter the “Weekend Warrior” savings plan. This one’s perfect for those quick, short-term trips—a couple of days at a cute cabin in the woods, or maybe a city break somewhere trendy.

The Plan

- Set a short-term goal: Figure out where you want to go and how much it’ll cost (hello, flight alerts!). Apps like Skyscanner and Google Flights will help you snag deals. Need a rough number? Try $500 as a baseline, including travel, lodging, and meals.

- Micro-saving: Use apps like Qapital or Chime that let you round up your purchases to the nearest dollar and stash the extra change into a savings account. It’s painless, and you’ll be surprised how fast it adds up.

- Cut just one thing: Don’t go crazy—just pick one small thing to skip each week. Maybe it’s that extra cocktail at happy hour, or you cut out delivery (just once, I swear). At $20 saved per week, that’s $80 a month straight into your travel fund.

Pro Tip: Look into credit cards with cash-back rewards like Chase Freedom or Capital One Quicksilver. Use them for everyday purchases and funnel that cashback directly into your travel savings.

2. The Aspiring Globetrotter: Saving for Longer Trips

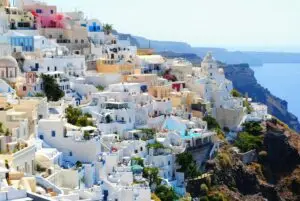

You’ve got bigger travel dreams. Maybe it’s a 10-day tour through Italy (wine and pasta, anyone?) or a long trek in Nepal. Either way, you’ll need a bit more of a savings cushion, but it’s totally doable—even if you’re on a modest budget. Time to buckle up for a mid-range savings plan that’ll have you globe-trotting without financial guilt.

The Plan

- Get a travel-specific account: Open a dedicated savings account just for your trip. Out of sight, out of mind, right? Banks like Ally and Capital One 360 offer high-interest savings accounts that help your money grow as you save.

- Automate your savings: Set it and forget it! Automate a portion of your paycheck to go directly into your travel fund. Even if it’s just $50 or $100 a month, it’ll feel like you’re paying yourself first, and you’ll barely notice it’s missing.

- Find a side hustle: I know, I know—side hustle culture is everywhere. But hear me out! Websites like Upwork or Fiverr let you take on small freelance gigs that you can do in your free time. If you rake in an extra $200 a month, that’s some solid trip money without having to sacrifice your regular budget.

Pro Tip: Sign up for a travel rewards credit card like the Chase Sapphire Preferred or American Express Platinum. Not only do these cards give you points or miles for your purchases, but some even come with perks like free travel insurance or no foreign transaction fees. Swipe smart, my friend.

3. The Wanderlust Dreamer: Saving for a Big, Life-Changing Trip

So you’ve decided that 2025 is the year you’re taking a two-month trek through Patagonia or finally backpacking through Southeast Asia. This is the big one—the trip you’ve been dreaming about for years. You’ll need a robust savings plan, but the good news is you can get there without selling your soul (or your stuff) in the process.

The Plan

- Create a realistic budget: You’ve got to figure out how much you’ll need—down to the last noodle in that street food stall in Bangkok. Use BudgetYourTrip.com to estimate costs for things like accommodation, food, and activities in different countries. Let’s say you’re aiming for $5,000-$10,000 depending on the trip.

- Cut back in strategic places: I’m not saying stop living your life, but maybe skip the big-ticket splurges for a while. Love grabbing takeout every week? Try cooking at home for a few months. Are you subscribed to five different streaming services? Cancel a couple, and that money can go straight into your travel fund.

- Start a sinking fund: Yep, it sounds boring, but it’s actually magic. A sinking fund is just a fancy way of saying you’re saving a little bit over time for a specific goal. If you’ve got two years to save, divide your total trip cost by 24 months, and that’s how much you should be setting aside monthly. Voila! You’ve got a plan.

- Travel hacking: Become a travel hacker. It sounds sneaky, but it’s just using credit card rewards to your advantage. Sign up for points-earning cards like the Chase Sapphire Reserve or Delta SkyMiles American Express and start racking up miles for your flight.

Pro Tip: Consider passive income options like renting out a room on Airbnb or selling things you don’t need on Facebook Marketplace or eBay. Every little bit helps pad that travel fund.

Bonus: Savings Tools That Make It Fun

Saving for travel doesn’t have to feel like a chore. In fact, with the right tools, it can be fun! Here are a few apps and hacks to make the process less “ugh” and more “yay!”:

- Digit: This app automatically analyzes your spending and moves small amounts of money into savings without you even noticing. It’s like the sneaky best friend of travel savings.

- Acorns (Our favorite choice) : Invest your spare change from everyday purchases into a diversified portfolio. Your extra pennies turn into a travel piggy bank over time!

- Travel fund jars: This one’s old-school but satisfying—get yourself a clear jar and start dumping your spare change in it. It’s surprisingly motivating to watch your fund grow in real life!

Final Thoughts: The World Is Yours—Just Start Saving!

No matter where you want to go or how tight your budget is, saving for travel is totally achievable with the right plan. From weekend getaways to multi-country adventures, there’s a strategy that’ll help you get there. You don’t have to give up everything you love or be a millionaire to see the world—just a little creativity, some smart planning, and boom, you’re on your way!

How are you saving for your next adventure? Got any clever hacks or tools that make it easier? I’d love to hear all about it—drop your tips in the comments and let’s inspire each other to travel more!

1 thought on “The Best Travel Savings Plans for Every Budget: Jet-Set Without Going Broke”

I was debating which card to choose for my upcoming trip around the Americas, but I finally ordered the new Sapphire Reserve Credit Card. Let’s see how it goes, guys, I’ll keep you posted soon! 😊